ct sports betting tax

Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting. Explore 2021 state legislative trends including the latest state sports betting tax legislation and trends.

Connecticut Sports Betting Best Ct Betting Apps 2022

Casino gambling and sports betting.

. When sports betting will be legalized the tax is expected to be at 7 - 10 or similar to lottery winning that stands at 699. Tax payments from sports betting operators in February were the lowest yet. The legislation is Public Act 21-23.

If the winner is a resident of Connecticut and. Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season. Connecticut Sports Betting Tax Rates Come Into Focus.

A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by a 20 tax rate for at. The gambling tax rate in the state of Connecticut is 699. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it.

Depending on your state legal sports. The payment due to the state is 1375 of gross gaming revenue for sports wagering and 18 for online casino gaming until 2026 when it will increase to 20. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident resident.

UP TO 1250 ON CAESARS. This season is expected to be the most. Total sports betting revenue in Nevada the amount kept by the.

The Law Regulations and Technical Standards for all forms of Online Gaming. Without any credits or deductions their tax liability on that income would be 4600 plus 55 of 50000 the excess over 100000 which would be 2750. Connecticut Sports Betting Tax Rate While many other states have flat tax rates those winning money in Connecticut will pay at different rates depending on their overall.

The Connecticut General Assembly has. Facilities are required to withhold 24 of your earnings for. Those winning money in Connecticut pay taxes at different rates depending on.

If you win money after you bet on sports in Connecticut you must pay a federal income tax on your winnings. How States Tax Sports Betting Winnings. The state taxes sports betting revenue each month from three master licensees.

600 or more - the payor is obliged to provide you. Large gambling wins in Connecticut over 1200 may be subject to an additional Federal Tax. Sports betting revenue in Nevada is a small fraction of revenues from other sources.

While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. Thus their grand total would be.

This rate applies equally to both. MOU Amendment - July 2021. Learn more about state sports betting tax bills.

If the winner is a part-year resident of Connecticut and meets the gross income test gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal. States have set rules on betting including rules on taxing bets in a variety of ways. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering.

Legal sports betting in Connecticut. Since PASPA was repealed by the Supreme.

New York Tops Nation In Sports Betting Tax Revenue As Promotions Taper Crain S New York Business

New York Takes A Gamble With 51 Tax On Online Sports Betting

Connecticut Keeps Adding Sports Betting Options Ny Sports Day

Connecticut Assumes New Tax Revenue From Gambling To Support Budget

Sports Betting Still On The Menu In Massachusetts And Connecticut

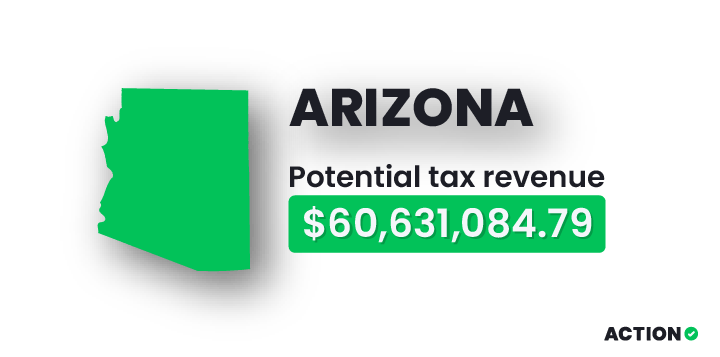

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

Income Taxes And Sports Betting In 2018 Taxact Blog

New York Online Sports Betting Gross Gaming Revenue Tops 1 Billion

Connecticut Nudges Sports Betting Handle Record To 158 Million

Gov Hochul Reports Record New York Online Sports Betting Tax Revenue

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

How States Are Spending Their Sports Betting Tax Revenue

Ct House Of Representatives Passes Legislation Regarding Online Gaming Sports Betting In State Fox61 Com

Connecticut Icasino Sports Betting Numbers Grow

Do You Have To Pay Sports Betting Taxes Smartasset

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sin Taxes On Sports Bets Legal Pot Gain Steam As Virus Rages

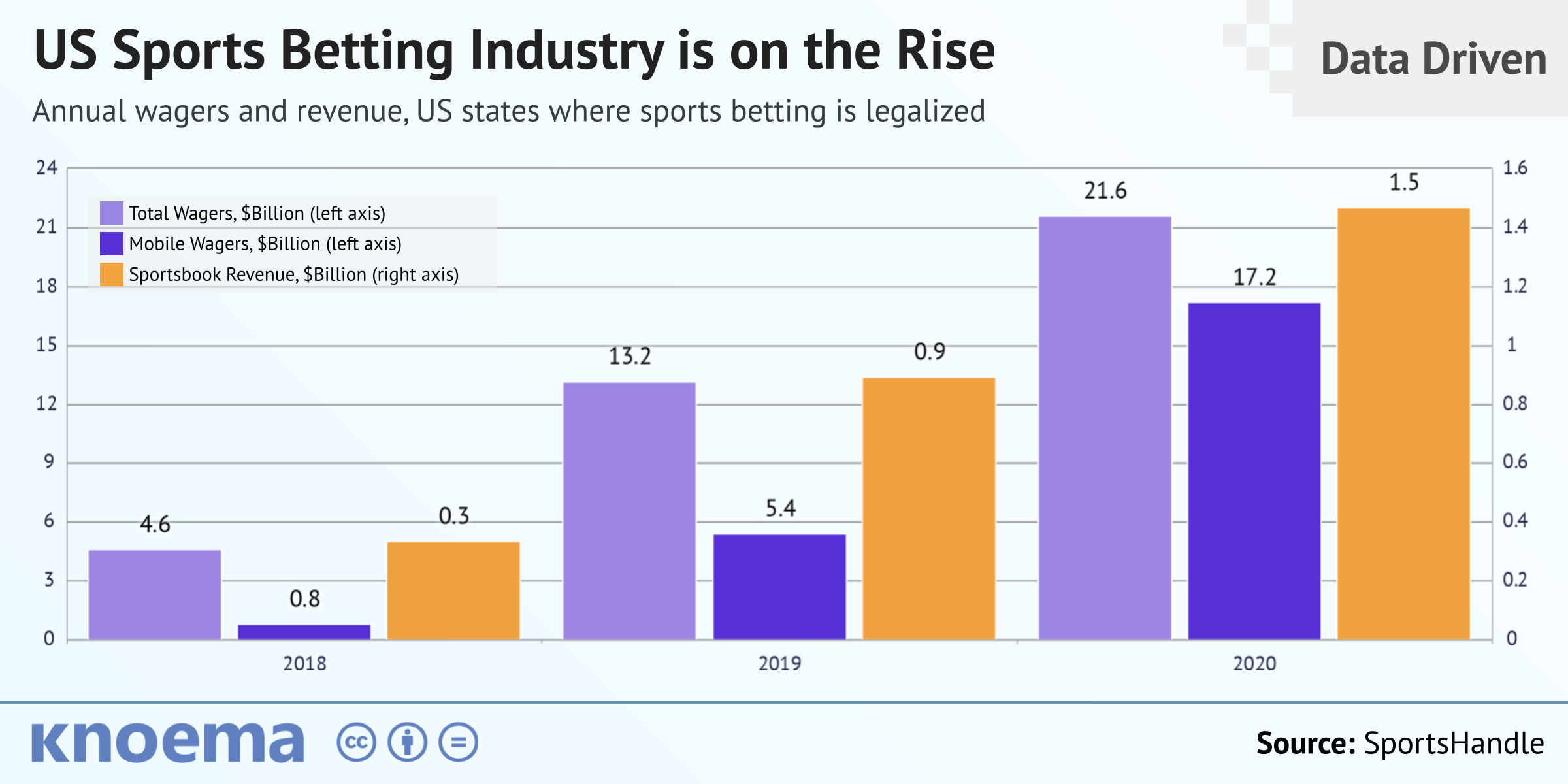

United States Sports Betting Industry Is On The Rise Knoema Com

Connecticut Governor Urges Approval Of Recreational Marijuana Sports Betting The Boston Globe